In 2014, a 16-year-old woman who was 25 weeks pregnant was hospitalized with severe pre-eclampsia, a serious complication characterized by high blood pressure. Her physicians contended that they advised her to undergo an emergency C-section, which she refused. The patient claimed that doctors told her that the baby would die or suffer brain damage if she had a C-section. Whichever the case, when the baby was delivered vaginally days later, it suffered severe damage. The mother filed a lawsuit, and in June of 2019, the case went to trial. After the parties rested, the jury came back in just two and a half hours with a staggering verdict in the amount of more than $229 million in favor of the plaintiff—the largest medical-malpractice verdict ever recorded.

For the last several years, the medical professional liability (MPL) industry has been experiencing increased financial pressure in response to the changing healthcare system and social inflation. In fact, since 2013 there have been a total of eight medical malpractice cases exceeding $100 million, including the aforementioned case; six of these cases have been in the last two years alone. This increase in the frequency and severity of claims, along with an extended period of downward competitive pressure on premiums, is prompting needed adjustments across the entire industry.

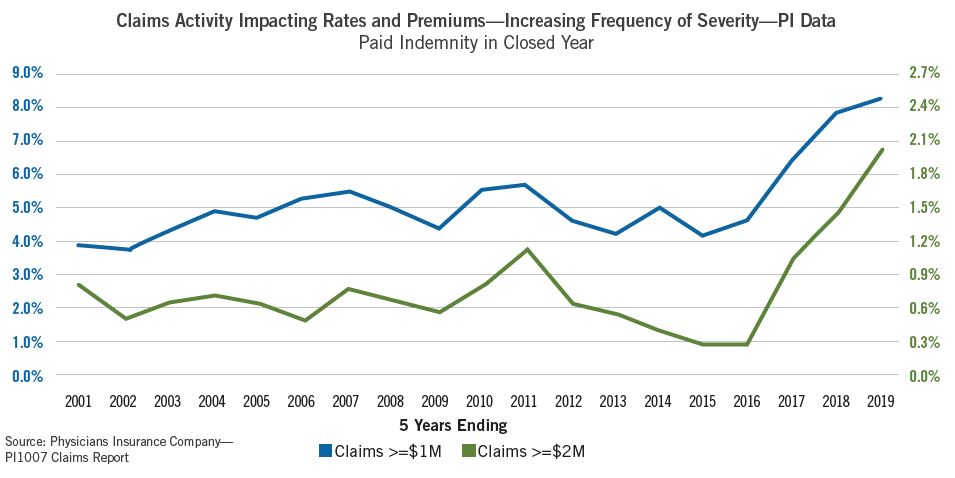

Locally, in the Pacific Northwest, Physicians Insurance’s experience during 2001 to 2019 also shows an increase in severity of claims beginning in 2016. In the four years between 2016 and 2020, the number of claims settling for more than $1 million and $2 million jumped 100% and 300% respectively. One key contributor to this marked increase is social inflation.

The term “social inflation” is a catchall phrase utilized in the insurance industry, but in general, it refers to the increase in loss costs due to shifts in distrust of corporations, juror compositions, and effective plaintiff-attorney strategies.

The recent wave of distrust of corporations makes it easier for a jury to believe that a faceless corporation with ample assets or insurance should be held responsible. Plaintiff attorneys use this distrust in corporations to alter how they file pleadings in malpractice cases, purposely naming only the healthcare entity as the defendant instead of individual providers responsible for the care.

Social inflation is also amplified by a new composition of juries. As the Millennial generation become jurors, their experience and mindset differs from those of prior generations. Plaintiff attorneys who want the jury to “send a message” will appeal to this generation’s broad mistrust in authority and paint experts as “authority figures,” hoping jurors will reject their testimony on prejudicial grounds.

Another factor contributing to overall increases in claims is the cost to defend them. The cost to defend a claim in the Pacific Northwest increased by nearly 60% since 2007. This means that not only are claims resolving for more and more indemnity (the sum of money paid out in the claim), but it is also costing more to defend them.

And while there are many factors that cause the value of cases to go up, the legislative and judicial environments within the Pacific Northwest also have a significant impact. Meaningful liability reform has eroded over the years; last year saw the introduction of a new class of beneficiaries in wrongful-death cases in Washington, allowing the parents and siblings of deceased parties to bring suit even if they don’t live in the U.S. and aren’t financially dependent on the deceased.

In Oregon, as a result of a recent Supreme Court case, there is now a new cause of action in malpractice claims allowing plaintiffs to claim the theoretical “loss of chance of a better outcome” as an injury. These claims are unique in that they allow patients, instead of claiming actual physical harm, to claim damages if they had the chance of a better outcome and the provider’s negligence eliminated that chance. Oregon also has a cap which has been heavily contested over the last few years. Since 1987 the cap for wrongful death and bodily injury has been heavily contested in the courts and in the legislature, with the plaintiff trial bar aggressively seeking to increase or eliminate the cap for both wrongful death and bodily injury.

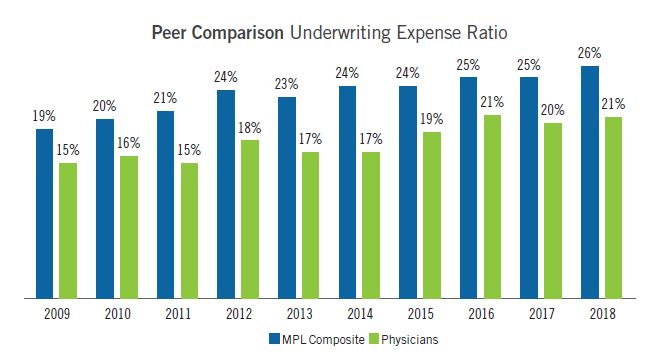

Ever since Physicians Insurance wrote its first policy in 1982, its focus has always been on protecting its members. As a result, Physicians Insurance regularly takes cases to court. Our defense verdicts at trial show that this strategy, though more expensive than just settling a case, is a consistently winning one for members. And, though PI may outspend its composite peer set in defending claims, the company consistently underspends its peers in administration and operating costs.

The healthcare and medical professional liability industries have gone through significant changes in the past five years. Well before the advent of the COVID-19 pandemic, the MPL industry was experiencing economic shifts and healthcare was reshaping itself through consolidation and employment models. While PI has kept base rates flat as long as possible by closely managing expenses and trying to offset increases through other means, claim costs continue to rise due to influences like social inflation and plaintiff-attorney tactics. As a mutual company owned by and operated for the benefit of our members, we plan to continue insuring, defending, and supporting our members well into the future. This will likely result in rate adjustments in the future, but they will always be made in keeping with our commitment to keep administrative and operating costs in line with our historic low levels.